There are many resources available to assist survivors, both individuals and businesses. Please take a few minutes and review all of these as you may be eligible but not know it yet.

If you represent a supporting agency or program that is not reflected on this page, please let us know at [email protected]

Call For Help (615) 338-7404

A Crisis Cleanup service is in place for Tennesseans who need help with debris removal and home cleanup from the recent flooding. All services are free, but service is not guaranteed due to the expected overwhelming need. Individuals needing assistance can call the hotline at 615-338-7404. For additional recovery resources, visit: http://tn.gov/…/middle-tennessee-flooding-recovery.html

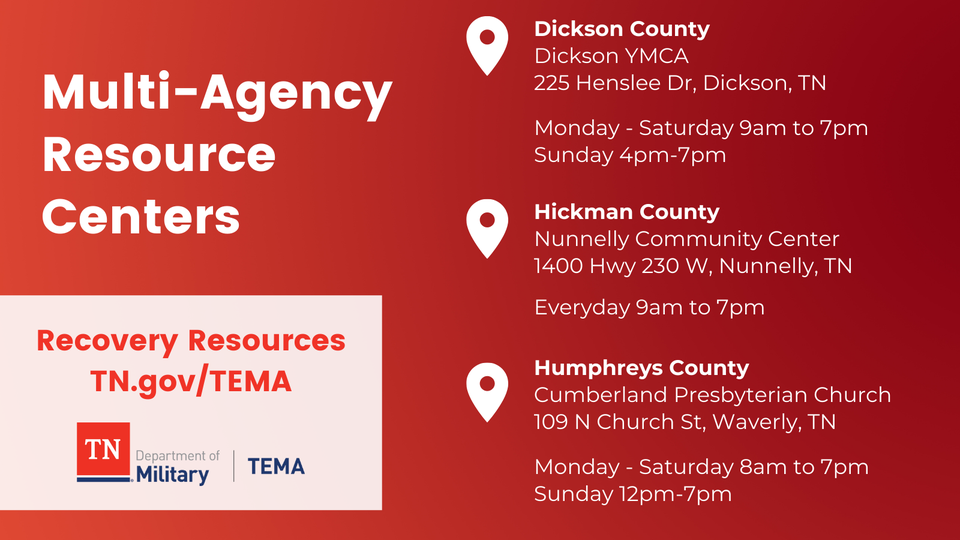

Multi-Agency Resource Centers (MARC) are open for those who would like to speak in-person about disaster assistance. Local, state, and federal agencies will be available to discuss programs and assistance with flood survivors. Location and hours below:Dickson CountyDickson YMCA225 Henslee Dr, Dickson, TNMonday – Saturday 9am to 7pm, Sunday 4pm to 7pmHickman CountyNunnelly Community Center1400 Hwy 230 W, Nunnelly, TNEveryday 9am to 7pmHumphreys CountyCumberland Presbyterian Church109 North Church St, Waverly, TNMonday – Saturday 8am to 7pm, Sunday 12pm to 7pm

The MARC connects flood survivors with federal, state, and local recovery resources. More info: http://tn.gov/…/middle-tennessee-flooding-recovery.html

SBA Assistance Options

In Primary Counties, physical disaster loans are available for businesses of all sizes, non-profits, faith-based organizations, homeowners and renters. (Rental property owners can apply for a physical disaster loan as a business.) Small businesses and eligible non-profit organizations will automatically be considered for a working capital loan when they apply for a physical disaster loan. SBA Primary Counties:

Dickson, Hickman, Houston and Humphreys

In Contiguous Counties, only working capital loans, known as Economic Injury Disaster Loans (EIDLs), are available to small businesses and eligible non-profit organizations. SBA Contiguous Counties:

Benton, Cheatham, Lewis, Maury, Montgomery, Perry, Stewart and Williamson

PROGRAM HIGHLIGHTS

- Applying for a disaster loan can be part of the FEMA process

- Applying for a disaster loan is FREE and there is NO PRESSURE to accept a loan; you can accept none, part, or all of the loan.

- If FEMA says, “apply to SBA,†and a survivor doesn’t; they won’t continue to move through the FEMA process

- If SBA denies a person’s loan application, we re-route them back to FEMA for potential additional grant consideration

- SBA will determine the loan amount based on your uncompensated losses

- Disaster loans are for one’s primary residence

- Owners of damaged rental property can apply as a BUSINESS for a disaster loan

- Driveways, garages, fencing, decks, and sheds are generally all eligible under the disaster loan program

- Terms up to 30 years make payments affordable, but there are no prepayment penalties for those who wish to pay off their loans early

- No collateral is required for loans of $25,000 or less

- The loans are direct from the U.S. Treasury, not a bank. The terms and interest rate don’t change.

- The first payment is not due until 18 months from the date of the note; however, interest accrues during that period

How to Apply:

To be considered for all forms of disaster assistance, applicants should register online at DisasterAssistance.gov or download the FEMA mobile app. If online or mobile access is unavailable, applicants should call the FEMA toll-free helpline at 800-621-3362. Those who use 711-Relay or Video Relay Services should call 800-621-3362.

For in-person assistance, business owners and ANY SURVIVOR can go to any recovery center for one-on-one SBA assistance.

SBA is operating two Business Recovery Centers (BRCs):

HUMPHREYS COUNTY – Waverly City Hall, 101 E. Main St., Waverly, TN 37185

DICKSON COUNTY – Dickson County Chamber of Commerce, 205 S. Main St., Dickson, TN 37055

The hours for both BRCs are 8 a.m.-4:30 p.m., Monday-Friday.

SBA staff are also available to help at the MARCs (Multi-Agency Resource Centers) operated by the TN Emergency Management Agency.

Applicants may apply online using the Electronic Loan Application (ELA) via SBA’s secure website at https://disasterloanassistance.sba.gov/ela/s.

Businesses and individuals may also obtain information and loan applications by calling the SBA’s Customer Service Center at 1-800-659-2955 (1-800-877-8339 for the deaf and hard-of-hearing), or by emailing [email protected].

Loan applications can also be downloaded at sba.gov/disaster.

What Types of Disaster Loans are Available?

- Business Physical Disaster Loans – Loans to businesses to repair or replace disaster-damaged property owned by the business, including real estate, inventories, supplies, machinery and equipment. Businesses of any size are eligible. Private, non-profit organizations such as charities, churches, private universities, etc., are also eligible. The law limits business loans to $2,000,000.

- Economic Injury Disaster Loans (EIDL) – Working capital loans to help small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private, non-profit organizations of all sizes meet their ordinary and necessary financial obligations that cannot be met as a direct result of the disaster. These loans are intended to assist through the disaster recovery period.

- Home Disaster Loans – Loans to homeowners or renters to repair or replace disaster-damaged real estate and personal property, including automobiles.

What are the Credit Requirements?

- Credit History – Applicants must have a credit history acceptable to SBA.

- Repayment – Applicants must show the ability to repay all loans.

- Collateral – Collateral is required for physical loss loans over $25,000 and all EIDL loans over $25,000. SBA takes real estate as collateral when it is available. SBA will not decline a loan for lack of collateral but requires you to pledge what is available.

What are the Interest Rates:

Interest rates are as low as 2.88% for businesses, 2% for nonprofit organizations, and 1.625% for homeowners and renters, with terms up to 30 years. Loan amounts and terms are set by the SBA and are based on each applicant’s financial condition.

What is the deadline:

The filing deadline to return applications for physical property damage is Oct. 22, 2021. The deadline to return economic injury applications is May 23, 2022.

Field Operations Center – East

U.S. Small Business Administration

(404) 331-0333

Home Page | Twitter | Instagram | Facebook | YouTube | LinkedIn | Email Alerts

More information

http://tn.gov/…/middle-tennessee-flooding-recovery.html